Our main goal is to get you out of debt!

We work only for our clients; not for the benefit of the creditors.

Becoming debt free is the first step to becoming financially secure, and our program may be your best option. Our program is actually quite simple.

How it works:

We will set you up with an affordable monthly payment plan , which is determined on a client-by-client basis between you and a counselor at Honest Debt. Based upon your free consultation with one of our experts,, we can determine how many months you will be a part of the program, and ultimately determine when you will be debt free.

We can enroll the following types of accounts

We Can Enroll:

Credit Cards

Unsecured Loans

Unsecured Personal Loans

Medical Bills

Unsecured Personal Lines of Credit

Collections

Autos in repossession

We Can’t Enroll:

Lawsuits

IRS

Utility Bills

Auto Loans

Government Loans

Most Credit Unions

Can Debt Validation Erase My Debt?

You may be able to legally walk away from a debt without paying a single cent by using debt validation, just like thousands of other consumers have done.

And it gets even better … the same debt that’s trashing your credit score right now–could get removed from your credit report entirely after getting disputed with debt validation.

CALL Honest Debt Today At 888-521-0777 for a free consultation

You have the legal right to dispute a debt before paying it, to be 100% certain that the debt collection company is operating lawfully.

After all, you don’t want to participate in any fraud and feed an illegal operation, do you?

Debt validation forces the debt collection company to produce complete and accurate records that federal laws require debt collection companies to maintain, and if they can’t–all collection activities will stop.

Debt validation can’t erase or clear your debt, but it can be the most effective and least expensive route to dealing with an unsecured debt and negative credit.

The New York Times recently reported; financial companies like American Express, Citigroup, Discover, Chase and all the Major Creditors:

- committed fraud in business dealings

- are using erroneous paperwork

- have incomplete records

- use faulty legal processes

Noach Dear, a New York Supreme Court Judge, estimated that 90% of credit card lawsuits are flawed and can’t prove the person owes the debt. 90%!

Source: The New York Times, https://dealbook.nytimes.com/2012/08/12/problems-riddle-moves-to-collect-credit-card-debt/, 01/27/2018

Debt Validation Vs. Debt Settlement

Why debt validation over debt settlement services?

- Pay less than what you would pay if settling a debt

- The debt comes off your credit report in many cases

- Faster results with validation

- No taxes owed if a debt is proven to be invalid

What happens if a Debt is Invalidated?

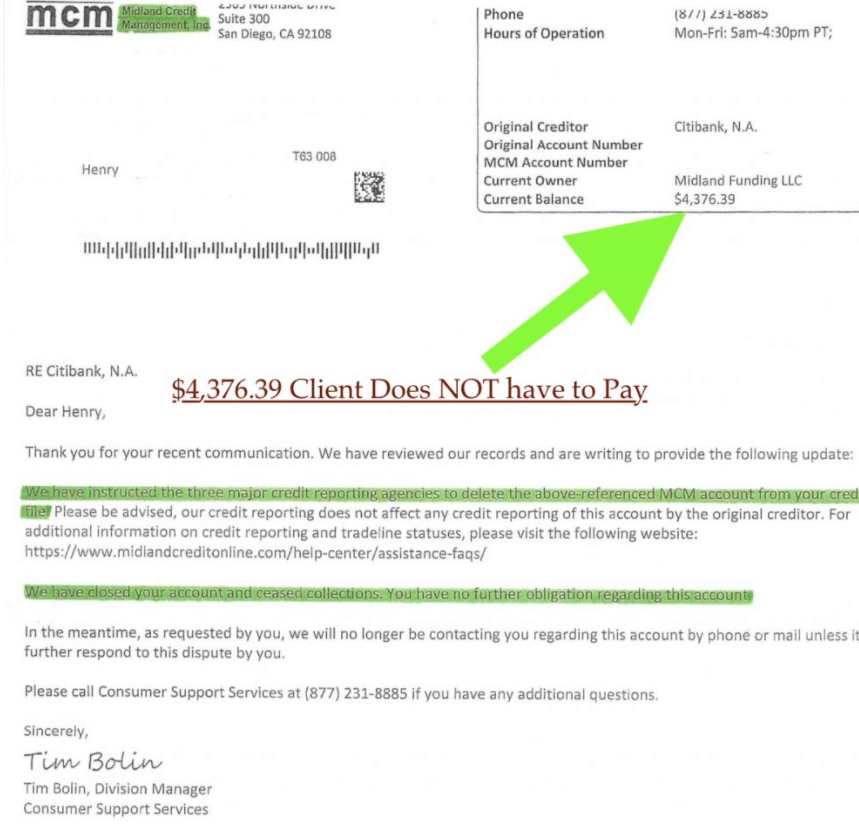

If a debt collection company can’t supply accurate information and complete documentation after a debt is disputed through debt validation–the debt becomes “legally uncollectible.”

A legally uncollectible debt is one that you don’t have to pay, and it can’t legally get reported on your credit report.

Debt validation can be the quickest way to deal with a bad credit card debt and third-party debt collection accounts. In many cases, debt collection companies will even agree to remove the debt from your credit report entirely, after they fail to validate it.

Debt Validation Letter (Citibank Debt Collection Account Cleared From Credit)

Benefits of a Debt Validation Program

The most obvious benefit of debt validation is illustrated in the example above–being able to legally walk away from thousands’ of dollars in debt and clear the negative marks off your credit report–and all within a few months.

- Stops fraudulent debt collectors

- Let’s you legally walk away from paying a bad debt

- Negative marks can be removed from credit

- Can be the least expensive debt relief option

- A debt validation program will continue disputing a debt if it’s taken over by another debt collection company, all the way up until the time that the statute of limitations has expired.

How Does a Debt Validation Program Work?

STAGE ONE: Credit reports need to illustrate accurate and verifiable information. The analytics department will help you review, identify and deal with all erroneous and derogatory marks that could be negatively affecting your credit score–ensuring mistakes are corrected.

STAGE TWO: After the initial credit report analysis – a case manager will start challenging and disputing each debt enrolled in the program. If the debt collection agency can’t prove, they have the legal authority to collect on a debt–the debt becomes legally uncollectible. In other words, an uncollectible debt is one–that you don’t have to pay.

CALL 888-521-0777 for a free consultation.

STAGE THREE: You get assigned to a “Violation’s Team.” Their sole purpose is to provide training and education to you regarding consumer rights, federal laws, and statutes. You learn how to defend yourself by using these laws (aimed at protecting consumers from unfair and illegal collection practices). Your Violations Team will give you tools and show you how to use them to protect yourself from harassment and other unlawful collection practices.

STAGE FOUR: RESULTS: This is the final step in a debt validation program. After the validation process is completed, your account manager will work with you on identifying any remaining items still negatively affecting your credit score. Your case manager will then get together with a credit expert in the analytics department to update your file and determine if any “next steps” are needed to take, ultimately working toward a brighter and healthier financial future.

How Much Does a Debt Validation Program Cost?

Call now at or apply online here to learn how much you can save with a debt validation program.

How Debt Validation Uses Federal Laws

The Fair Credit Billing Act (FCBA) – this law is used to determine if there are any billing errors.

The Fair Debt Collections Practices Act (FDCPA) – this law is used to determine if a debt collection company is using any abusive, deceptive, or unfair collection activity.

The Truth In Lending Act (TILA) – this law is used to determine the “real cost” of an alleged debt and how the balance was calculated and requires certain disclosures on your billing statement. TILA gives consumers the right to cancel a transaction and dispute a bill.

The Credit Card Act of 2009 – this law protects consumers from getting charged excessive fees and interest rates, and prohibits credit card companies from increasing interest rates retroactively or without fair notice and is used to make it easier for consumers to pay down credit card debt.

The Fair Credit Reporting Act (FCRA) – this law is used to ensure accurate information gets reported on a consumer’s credit report.

Debt Validation Demands Proof:

- that the debt is valid

- that the debt is a legally owed obligation

- that the debt collection company has accurate information–devoid of errors

- and the debt collection company must provide complete accounting including where the funds lent originated

And these are just a few examples!

If a debt collection company can’t produce all of these required items and accurate information–they must IMMEDIATELY cease collection activities and cannot legally continue reporting the debt to the credit reporting agencies.

Examples of Documents & Information Being Requested Through a Debt Validation

- the debt collection company must provide the original agreement that was signed when the debtor first was approved for the credit card or loan (original signature must be on it)

- the debt collection company must provide their debt collector license for whatever state they’re trying to collect on debt in

- the debt collection company must provide the name and address of the original creditor

- the debt collection company needs to know when the statute of limitation expires for a particular debt and they need to explain how they determined this date

The Speeding Ticket Analogy to Help Understand Debt Validation

You may have been speeding, but a competent lawyer can still get a speeding ticket dismissed right?

How?

A lawyer will challenge the police officer, looking for mistakes and missing documentation.

If the police officer disobeys the required procedures and protocols, a lawyer can use these breaches, inaccuracies, and flaws to get the speeding ticket dismissed; even though in reality you may have been speeding.

If the police officer wrote the wrong date or license plate number on the ticket–the ticket gets DISMISSED under the court of law.

At court, the lawyer may request to review certain required documents–such as; the documentation illustrating what type of instrument was used to calibrate the speed at which they are alleging you were doing, and if the police officer can’t provide these required legal documents–the ticket gets DISMISSED.

Yeah, that’s right. Just as if you weren’t speeding at all. No punishment, fine or violation on your record. Just a clean slate.

The concept of how a lawyer can get a speeding ticket dismissed is similar to how debt validation can prove a debt to be legally uncollectible.

However; when it comes to debt there are even more laws that can be used to dispute it, making debt even easier to invalidate than what it takes a lawyer to get a speeding ticket dismissed.

How is debt validation possible? Are the banks this careless?

When a debt collection agency purchases debt from the original creditors (credit card companies and banks), often these debts are sold with inaccurate records, missing documentation and even falsified records.

Due to the bank’s inability to maintain appropriate records, is one of the reasons why debt collection companies can purchase debt for such a low price–sometimes for as low as 5-cents on the dollar.

Most debtors are unaware of their consumer rights and the federal laws that regulate third-party debt collection companies, and therefore, they often become victims of predatory lenders and abusive debt collectors.

Bank and Debt Collection Company Fraud, how often does it occur?

Google “debt collection company scams” or “bank fraud,” and you will find there is no shortage of bank and debt collection fraud and abuse. Check out this recent article; CHASE BANK JUST BUSTED FOR FRAUD — CHASE MUST IMMEDIATELY STOP COLLECTION ON OVER 500,000 CREDIT CARD ACCOUNTS

Why doesn’t everyone do debt validation?

Most people won’t challenge a debt–they’re scared after an abusive debt collector threatens to sue them. They take out their wallet and pay, not knowing that if they disputed the debt, there is a chance the debt collection company would not be able to verify and validate it as a legally collectible debt.

The downside to debt validation

- Credit gets negatively affected in the beginning, as your creditors aren’t getting paid each month

- Credit card companies can issue you a summons

- If a debt is determined to be invalid or invalidated, the debt collection company can give the account back to the original creditor, where collection activities continue

Will a Debt be Erased, Cleared or Disappear After Getting Invalidated?

Technically, a debt won’t disappear when it gets invalidated.

A debt would only “disappear” or be “cleared” after the statute of limitations is reached on a particular debt. Debt validation companies may need to get a debt invalidated multiple times, and eventually, the creditor will give up in most cases.

Honest Debt recommends a debt validation program where the debt validation company stays with you until the statute of limitations arrives.

From an outside standpoint, it appears as if the debt is gone because it may come off your credit and you don’t have to pay it, but technically speaking–the debt does still exist.

How Long Does a Debt Collector Have to Verify a Debt?

The debt collection company must respond to a debt validation request within 30-days. If they fail to do so, the debt becomes legally uncollectible and invalidated.

You can dispute a debt collection account at any time. It is not true that you need to dispute a debt within 30 days after it goes to a collection agency, this is just a misconception.

Can a Debt Collection Company Garnish My Wages?

Besides federal student loan debt, with all other unsecured debt, a creditor must first take you to court and win a default judgment–before they can garnish your wages. The key is to dispute a debt as soon as you possibly can, because once the dispute arrives at the debt collection company’s doorstep–now all collection activity must stop until they verify the validity of the debt.

If a debt collection company issues you a summons before you dispute the debt, well now debt validation won’t work. In this case, you can show up at court and will most likely win just by showing up. Creditors gamble on the fact that most debtors will skip court and they will then win by default. As mentioned above, 90% of credit card lawsuits are flawed and inaccurate, so just by showing up at court you can win.

Here’s what the Center for Responsible Lending had to say …

“The agreements between debt sellers (major banks) and debt buyers (third-party debt collection companies) often dictate that accounts are sold “as is” with limited information and documentation for the accounts. As a result, unreliable records are used to collect or bring suits on debts that cannot be substantiated, are inaccurate in amount, or may not be owed by the consumer.”

Here’s what the FTC had to say…

Another report illustrated that “the FTC concluded that the information received by debt buyers (debt collection companies) is frequently “inadequate and results in efforts to collect from the wrong person or to collect the wrong balance and payment. Account documentation, when provided, may be filled with wrong and inaccurate information, and that the provision of account documents could not be depended on to determine the outstanding balance of an account or that the account represented a valid and collectible amount.”

Source: Center for Responsible Lending, http://www.responsiblelending.org/state-of-lending/reports/11-Debt-Collection.pdf, The Center for Responsible Lending, 02/02/2020